Check out : this app to know your cibil credit score for free !

In order to get loan from a bank, a person should have a good cibil credit score on myscore cibil. Those people who haven’t took much loan even they too would have poor cibil score on myscore cibil. Careless credit card transactions would have led to poor cibil score.

Planning to take a loan? Want to ensure that it is approved and processed quickly? Are you on the lookout for a loan at a lower interest rate? Then ensure that your cibil score is good.

Prior to taking loans, it is necessary to check your cibil score and in case your cibil score is low it needs to be improved.

Let us see how to check cibil credit score

What is Trans-Union Cibil?

Trans-Union Cibil Limited is India’s maiden credit information firm. It is also known as Credit Bureau. Records of payments related to loans and credit cards of individuals and commercial establishments will be collected and preserved. These documents can also be submitted to banks and other lenders on a monthly basis. Using this information, a cibil score and myscore cibil report for individuals has been developed. It enables lenders to evaluate and approve loan applications. The Credit Bureau is licenced by the RBI under the Credit Information Companies Regulation Act, 2005.

Why is cibil score important for loan sanctioning?

Cibil score plays a crucial role in the loan application process. When applying for a loan to a lending bank or lender, the first thing they will check is the applicant’s cibil score. If the applicant’s cibil score is low, the lender will not consider the application further and is more likely to reject the application. But if the cibil score of the applicant is high, then the lender will check the application and consider other details. Those with high cibil score have high chances to get loan easily.

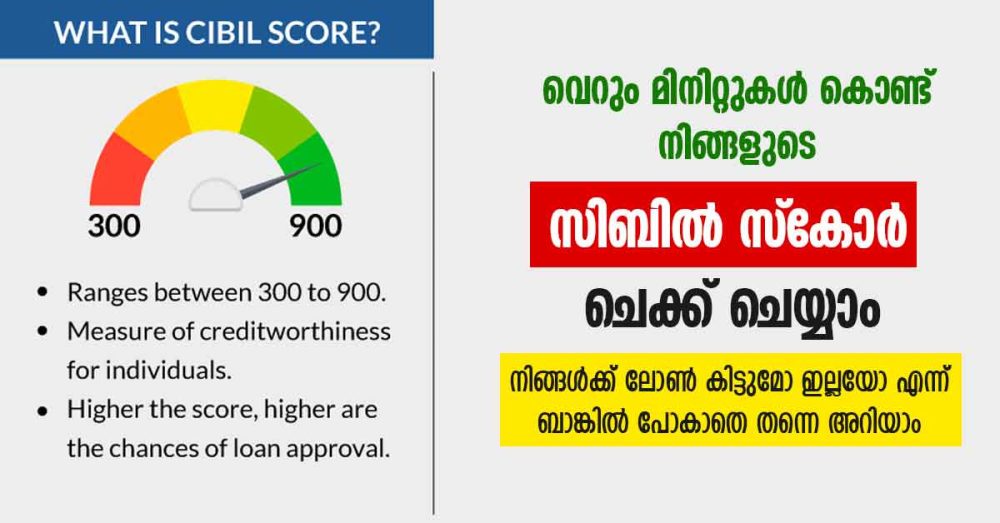

What is cibil score?

The Credit Information Bureau (India) Limited (CIBIL) is the most popular of the four credit information companies which are licensed by the Reserve Bank of India. There are three other companies namely Experian, Quifax and Highmark which are also licensed by the RBI to function as credit information companies. The most popular credit score in India is the Cibil score.

CIBIL Limited maintains credit files on 600 million individuals and 32 million businesses. CIBIL India is part of TransUnion, an American multinational group. Hence, credit scores are known in India as the CIBIL TransUnion score.

This report is prepared on basis of things like how responsible you are in taking loans and how much importance you attach to timely repayment. A cibil score is a three-digit number between 300 and 900. The cibil score required for approval of a loan is 750. The closer your score is to 900, the better your credit rating will be.

What does credit history and credit report mean in Cibil?

When you need a loan the first question you need to ask yourself is regarding what your cibil score is and will you be credit-worthy? Your bank will check your credit-worthiness through your credit history and make a credit report.

A credit history is a record of a borrower’s repayment of debts. A credit report is a record of a borrower’s credit history from various sources such as banks, credit card companies, collection agencies, and governments. A borrower’s credit score is the result of a mathematical algorithm applied to credit information to predict how credit worthy you are.

A cibil credit score takes time to build up and it takes between 18 and 36 months or more of credit usage to get a satisfactory credit score.

How to improve your Cibil score?

Pay dues on time, late payments are viewed negatively by borrowers, don’t use too much credit, always manage your spending wisely, unsecured loans will come as negative and apply for new credit in moderation.

Can cibil score records be corrected?

Cibil itself cannot delete or change records that reflect your CIR.

What is cibil score 2.0?

Cibil score 2.0 is the updated version of cibil score. It is designed keeping in mind the current trends and changes in customer profiles and credit data.

For cibil credit score: cibil score check online : CLICK HERE